Takaful Witnessing Double Digit Growth

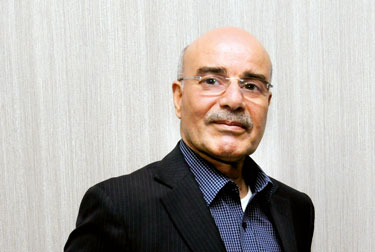

Hussein Mohammed Al Meeza, Managing Director and Chief Executive Officer of Dubai Islamic Insurance and Reinsurance Company (AMAN) was the first to look seriously at the role of Takaful in the United Arab Emirates and how far it helps consumers, governments and global economies.